The Advantages of Submitting an Online Tax Return in Australia for Faster Handling and Refunds

The Advantages of Submitting an Online Tax Return in Australia for Faster Handling and Refunds

Blog Article

Navigate Your Online Tax Return in Australia: Necessary Resources and Tips

Browsing the online tax return procedure in Australia calls for a clear understanding of your obligations and the resources offered to simplify the experience. Crucial documents, such as your Tax Obligation Documents Number and revenue declarations, need to be thoroughly prepared. In addition, picking a proper online platform can substantially affect the efficiency of your filing procedure. As you take into consideration these aspects, it is important to also know common challenges that several encounter. Recognizing these nuances might ultimately save you time and minimize stress and anxiety-- resulting in an extra favorable end result. What approaches can best aid in this venture?

Comprehending Tax Obligation Obligations

Recognizing tax responsibilities is crucial for people and businesses running in Australia. The Australian taxation system is regulated by various legislations and laws that require taxpayers to be mindful of their responsibilities. Individuals should report their earnings properly, that includes salaries, rental earnings, and financial investment earnings, and pay taxes appropriately. Locals need to recognize the distinction in between taxed and non-taxable income to make certain compliance and enhance tax obligation results.

For services, tax obligations encompass numerous facets, consisting of the Goods and Services Tax Obligation (GST), company tax, and payroll tax obligation. It is essential for businesses to sign up for an Australian Service Number (ABN) and, if applicable, GST registration. These responsibilities require careful record-keeping and timely entries of tax returns.

Additionally, taxpayers need to recognize with available reductions and offsets that can reduce their tax obligation concern. Seeking recommendations from tax specialists can offer valuable insights right into enhancing tax obligation settings while ensuring conformity with the law. Generally, a comprehensive understanding of tax obligation obligations is crucial for effective monetary preparation and to prevent fines connected with non-compliance in Australia.

Necessary Files to Prepare

Additionally, put together any type of appropriate financial institution declarations that mirror passion income, as well as dividend statements if you hold shares. If you have other income sources, such as rental residential properties or freelance job, guarantee you have documents of these incomes and any kind of linked expenditures.

Consider any kind of personal wellness insurance declarations, as these can impact your tax commitments. By gathering these important records in development, you will simplify your online tax obligation return process, decrease errors, and make the most of possible refunds.

Picking the Right Online Platform

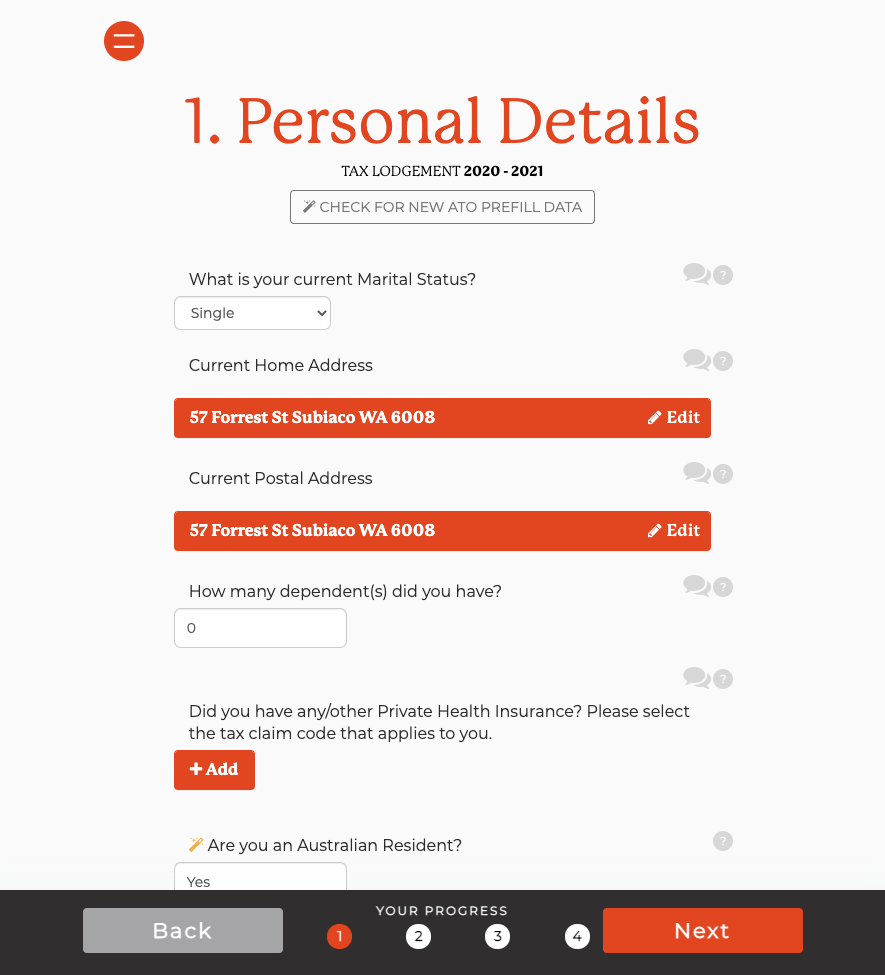

As you prepare to submit your online tax obligation return in Australia, selecting the appropriate platform is necessary to guarantee precision and simplicity of usage. Several crucial factors ought to lead your decision-making process. Think about the system's user interface. A simple, instinctive design can substantially enhance your experience, making it much easier to navigate complicated tax return.

Following, evaluate the system's compatibility with your financial scenario. Some solutions provide particularly to individuals with simple tax returns, while others offer detailed assistance for a lot more complicated circumstances, such as self-employment or financial investment revenue. Look for platforms that offer real-time mistake monitoring and advice, aiding to lessen errors and making sure compliance with Australian tax laws.

An additional vital facet to think about is the level of customer assistance readily available. Trusted systems must supply access to assistance using e-mail, phone, or conversation, specifically throughout top filing durations. Furthermore, research customer evaluations and ratings to assess the general contentment and reliability of the platform.

Tips for a Smooth Filing Refine

Filing your online income tax return can be an uncomplicated process if you adhere to a few key ideas to guarantee efficiency and accuracy. Initially, gather all needed documents prior to beginning. This includes your income declarations, invoices for deductions, and any kind of other appropriate documentation. Having everything handy reduces disturbances and errors.

Following, benefit from the pre-filling attribute offered by numerous online platforms. This can save time and minimize the opportunity of mistakes by immediately occupying your return with details from previous years and information given by your company and monetary institutions.

In addition, ascertain all access for precision. online tax return in Australia. Mistakes can bring about postponed refunds or problems with the Australian Tax Office (ATO) Ensure that your individual information, income numbers, and deductions are proper

Filing early not just decreases stress yet likewise allows for far better preparation if you owe tax obligations. By following these go to website pointers, you can browse the online tax return process smoothly and confidently.

Resources for Support and Support

Browsing the complexities of on-line tax returns can sometimes be complicated, yet a range of sources for support and assistance are readily available to aid taxpayers. The Australian Taxation Workplace (ATO) is the key source of info, offering thorough guides on its web site, consisting of FAQs, training video site here clips, and live chat choices for real-time aid.

Additionally, the ATO's phone assistance line is readily available for those who like straight communication. online tax return in Australia. Tax specialists, such as registered tax representatives, can also supply customized support and ensure compliance with present tax obligation laws

Final Thought

To conclude, successfully navigating the on-line tax return procedure in Australia requires an extensive understanding of tax obligation commitments, thorough prep work of essential files, and careful selection of an appropriate online platform. Adhering to practical tips can boost the declaring experience, while offered resources provide valuable assistance. By coming close to the procedure with persistance and interest to detail, taxpayers can ensure conformity and make the most of potential advantages, eventually adding to a much more efficient and successful income tax return end result.

As you prepare to submit your on the internet tax return in Australia, choosing the best system is essential to guarantee precision and simplicity of usage.In final thought, properly navigating the on-line tax return procedure in Australia requires a detailed understanding of tax commitments, precise prep work of vital records, and cautious option of a suitable online system.

Report this page